working capital turnover ratio formula class 12

We now look at the meaning and characteristics of working capital turnover ratio as mentioned in the chapter on accounting ratios class 12. Current Assets of a company are Rs.

Working Capital Turnover Ratio Meaning Formula Calculation

Let the Current Liabilities be Rs.

. Take the Next Step to Invest. Calculate Current Assets Current Liabilities and Quick Ratio. 700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times.

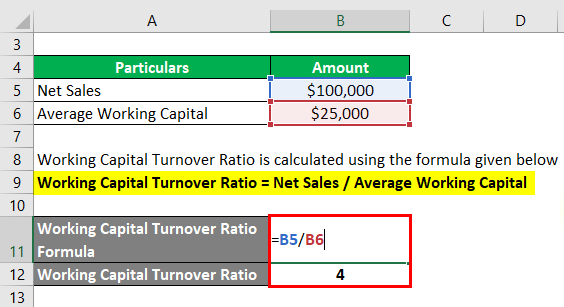

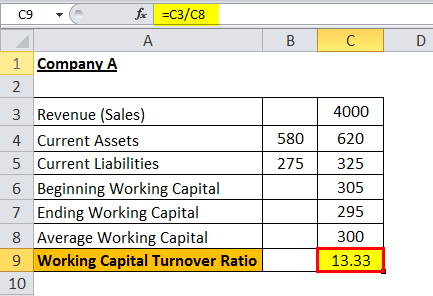

Working Capital Turnover Ratio Formula. Current Ratio 3 1 Workings. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets.

Net Credit Sales 18 00000. If a company has a higher level of working capital it shows that the working capital of the business is utilized properly and on the other hand a low working capital suggests that business has too many debtors and the inventory is unused. Working capital turnover Net annual sales Working capital.

Working Note-Net Revenue from Operations Rs. The formula for calculating working capital turnover ratio is. From the following information compute the current ratio.

Working Capital Turnover Ratio. Current Ratio 900000300000. Working Capital turnover ratio Accounting Ratio Activity ratio class 12 Accounts video 110class 12 Accountsaccounting ratiosworking capital turnover.

It signifies that how well a company is generating its sales with respect to the working capital of the company. The working capital of a company is the difference between the current assets and current liabilities of a company. When inventory and current assets given Ratio Analysis Class 12 Example 10.

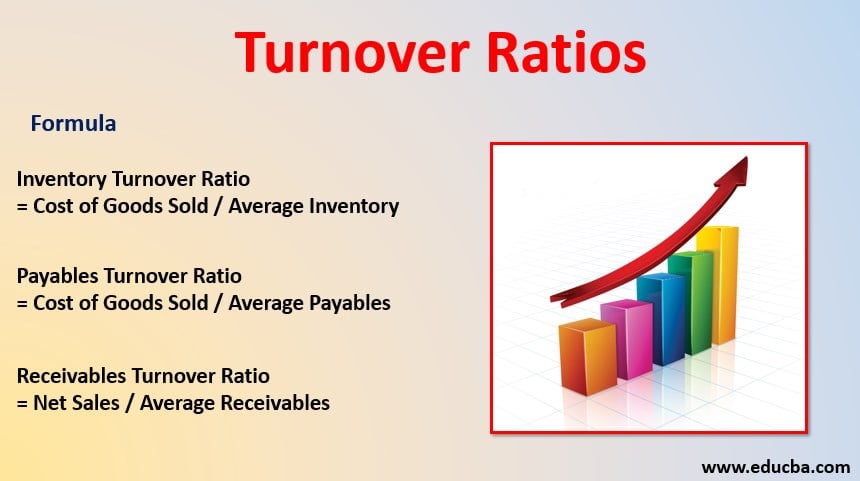

Working capital turnover ratio Sale or Costs of Goods Sold Working Capital. The formula for calculating this ratio is by dividing the sales of the company by the working capital of the. Working capital turnover ratio Sale or Costs of Goods Sold Working Capital.

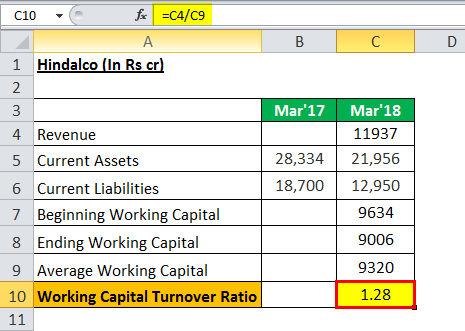

700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times. Working capital turnover ratiocost of revenue from operations or revenue from operations i. What this means is that Walmart was able to generate Revenue in spite of having negative working capital.

Working capital Turnover ratio Net salesWorking capitalNet sales Total sales - sales return 130000 380000 10000 500000Working capital Current assets - current liabilities 140000 90000 - 105000 125000Working capital turnover ratio 500000125000 4 times. Working capital turnover Net annual sales Working capital. Net sales Beginning working capital Ending working capital 2 Example of the Working Capital.

Working Capital Turnover Ratio 15000 2500. This means that the inventory turns over 333 times in a year for. Working Capital Turnover Ratio 1.

The formula for calculating working capital turnover ratio is. The formula for calculating working capital turnover ratio is. It reflects relationship between revenue from operations and net assets capital employed in the business.

When ratios are calculated on. 700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times. From the following information calculate the working capital turnover ratio.

Calculation of Working Capital Turnover Ratio-Working Capital Turnover Ratio Net Revenue from operations Working Capital Working Capital Turnover Ratio Rs. Net Working Capital Current Assets excluding Fictitious assets Current liabilities. Net Working Capital and Revenue from Operations ie Net Sales.

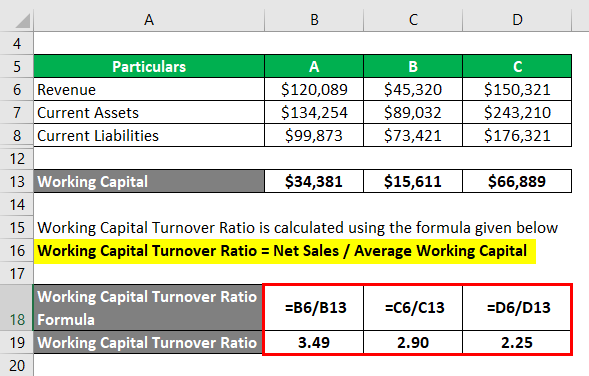

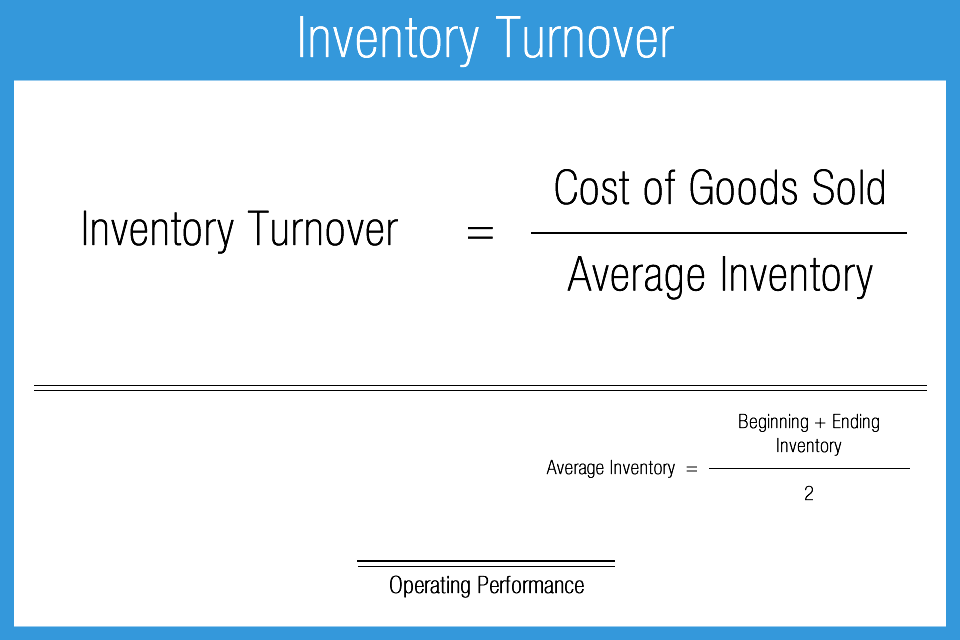

Capital Turnover Ratio 500000 40000 125 Interpretation It means each of capital investment has contributed 125 towards the companys sales and this 125 seems that the utilization of capital investment is done efficiently by the company. Working Capital Current assets - Current liabilities 600000 900000 - Current liabilities Current liabilities 300000. Inventory turnover ratio Cost of goods sold Average inventory.

Working capital turnover ratio interpretation. This means that every dollar of working capital produces 6 in revenue. And Average Inventory Beginning inventory Ending inventory 2.

Working capital turnover ratio 1850000370000. Working Capital Turnover Ratio 6 Times Working Capital Turnover Ratio of six times shows that sales in 6 times that of employed assets of working capital should be compared to the previous years data as well as other players in the industry to get a better sense. Its current ratio 25 and liquid Ratio is 085.

Accounting Ratios It is a mathematical expression that shows the relationship between various items or groups of items shown in financial statements. CBSE Class 12 Accountancy Important Questions Chapter 13 Accounting Ratios. Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x.

The questions and answers of how is provision for doubtful debt a part of current liability in inventory turnover ratio and working capital turnover ratio are solved by group of students and teacher of class 12 which is also the largest student community of class 12. It establishes the relationship between. Trade Payable Turnover Ratio Purchases Average Trade Payables Purchases Creditors Bills payable 420000 90000 52000 420000 142000 296 times d Working Capital Turnover Ratio.

NCERT Solutions for Class 12 Commerce Accountancy Chapter 5 Accounting Ratios are provided. This is reflected in a higher inventory turnover ratio. NCERT Solutions for Class 12 Commerce Accountancy Chapter 5 Accounting Ratios are provided.

Meaning of Working Capital Turnover Ratio. Accounting Ratios CBSE Notes for Class 12 Accountancy Topic 1. Revenue from the operation for the year were RS.

As clearly evident Walmart has a negative Working capital turnover ratio of -299 times. Ratio It is an arithmetical expression of relationship between two related or interdependent items. The working capital turnover ratio is thus 12000000 2000000 60.

Working capital turnover ratio 5 Times Working note 1. Inventory Turnover Ratio 500000 150000 333. Therefore Average Inventory 155000 245000 2 150000.

It is a relationship between working capital and revenue from operations. Working Capital Turnover Ratio. Working capital Current assets - Current liabilities Working capital 550000 - 180000.

Calculate the inventory turnover ratio. It shows the number of times a unit of Rupee invested in working capital produces sales. Current Ratio 3 1 Workings.

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Different Examples With Advantages

Capital Turnover Definition Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

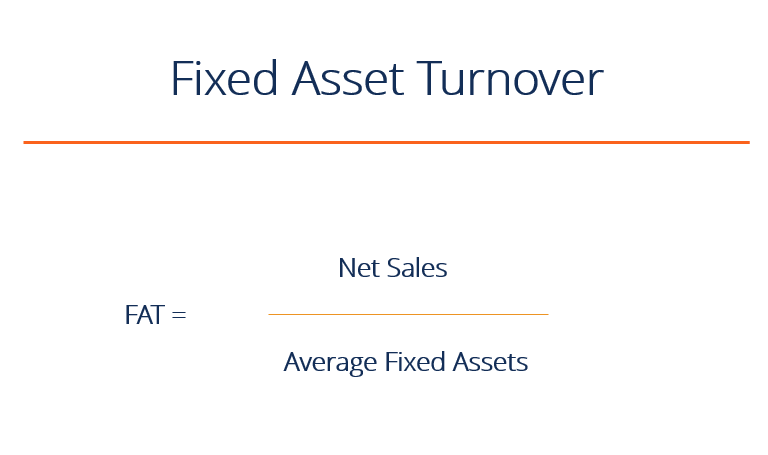

Fixed Asset Turnover Overview Formula Ratio And Examples

Working Capital Turnover Ratio Formula And Calculator

4 Best Financial Ratio Analysis Technique Discussed Briefly Financial Ratio Trade Finance Business Finance

Capital Stock Accounting And Finance Financial Management Accounting Basics

Financial Ratios Financial Ratio Accounting Education Financial Statement Analysis

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Calculator Excel Template

Turnover Ratios Example Explanation With Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio What It Is And How To Calculate It Planergy Software

Working Capital Turnover Ratio Meaning Formula Calculation

Asset Turnover Ratio Formula Meaning Example And Interpretation

Inventory Turnover Checkout Accounting Play